Here’s A Quick Way To Solve A Tips About How To Find Out How Much I Paid In Property Taxes

How do i find the amount of property taxes i paid?

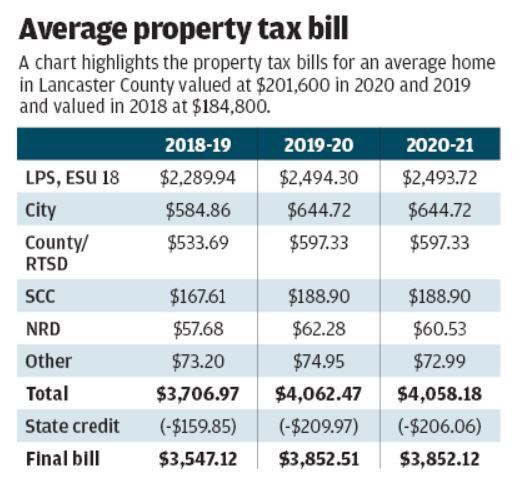

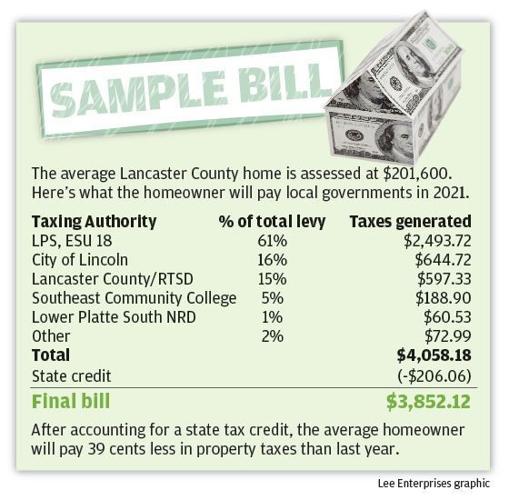

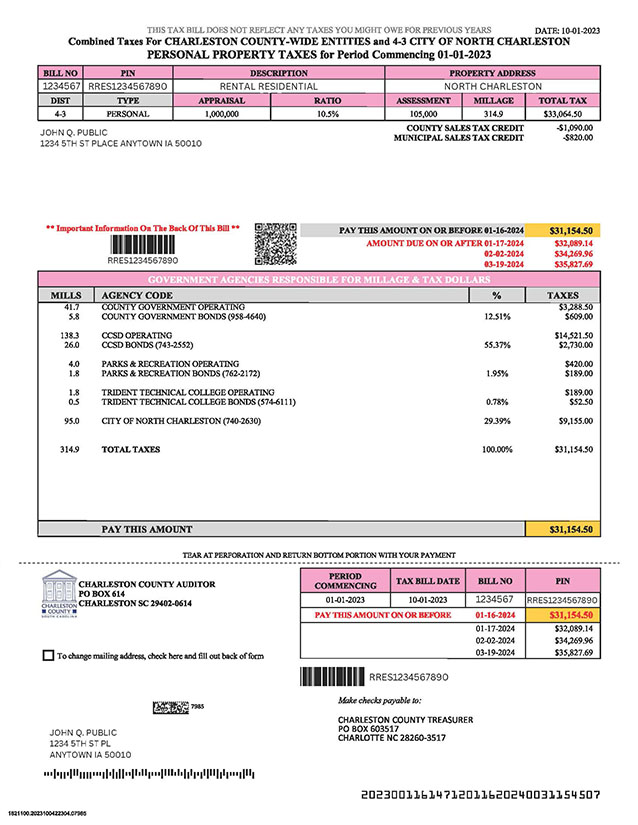

How to find out how much i paid in property taxes. Each property owner in the municipality pays a proportion of that $2,000 based on their property’s assessed value. Multiply the appraised value by the “assessment percentage” for your property _ times _% = assessed value. The property appraiser does not determine the amount of taxes you pay.

31 if you paid $600 or more in. Property tax returns and payment. Multiply the assessed value by your “mill levy” and then divide by.

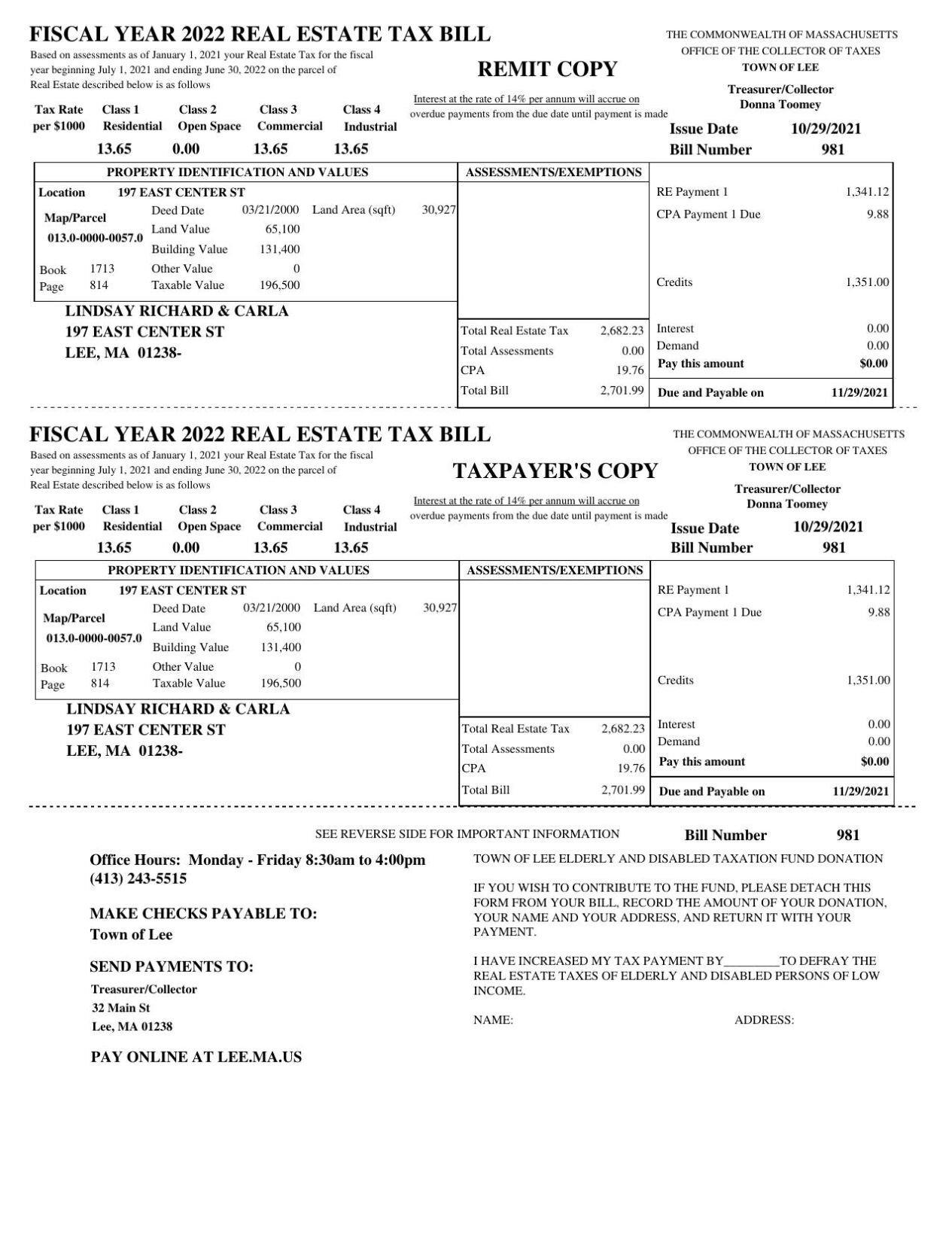

Property tax is administered and collected by local governments, with assistance from the scdor. The answer is yes, you most likely will have to pay property taxes on your apartment. You can find out the total amount of property tax you paid by looking at box 10 (“other”) of irs form 1098.

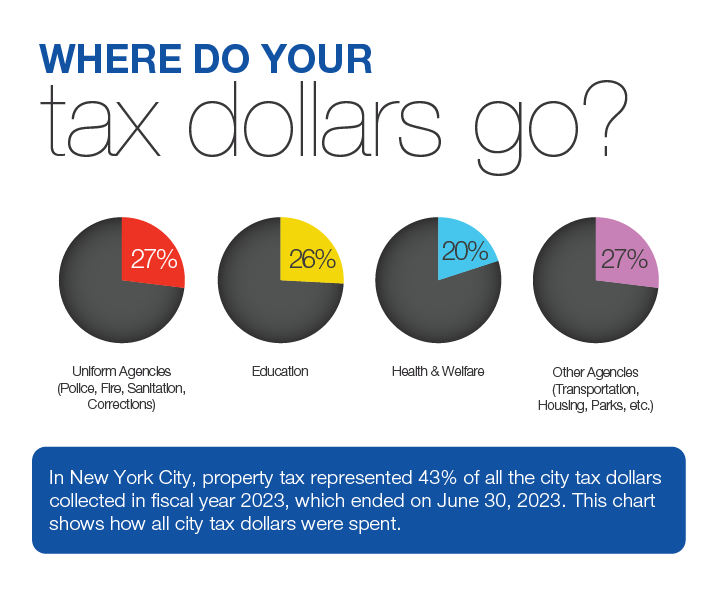

Visit the website of the county assessor to which you pay property taxes. The total amount that will be billed in property taxes. An amount determined by the assessor's office and is used in the calculation of the tax bill of a property.

Your lender sends this to you by jan. The property tax assessment determines the taxable. However, the taxing authorities use the property appraiser's assessment value to determine the taxes they levy.

The property tax account is being reviewed prior to billing. In keeping with our mission statement, we strive for excellence in all areas of property tax collections. This is calculated by first adding up the value of all three.